OUR ARTICLES

INDUSTRY MEETS LIFE

ClearTrust Industry & Life Entries

Check out our articles below where we merge life experiences with hot topics in the stock industry.

NOBO, OBO, AND STREET VOTING EXPLAINED

In the world of corporate governance and shareholder communications, terms like "NOBO" and "OBO" often cause confusion. Understanding these concepts and the process of distributing meeting materials and collecting votes from street investors is crucial for effective shareholder engagement. Let's break it down.

EMBRACING RHYTHMS OF WORK + REST

At ClearTrust, our primary mission has always been clear: we exist for the flourishing of our families and stakeholders. Profit, while important, is secondary—a byproduct of our higher, perhaps idealistic aim of fostering genuine growth and well-being. This philosophy is why you'll never see ClearTrust expanding beyond our capacity; we refuse to outpace our own team. Our commitment to being a workplace that cultivates holistic flourishing has led us to critically examine our rhythms of work and rest.

ESCHEATMENT EXPLAINED

All businesses are required by law to report unclaimed property on an annual basis. Each state imposes its own unique unclaimed property laws and regulations with changes occurring almost daily. Examples of unclaimed property are tangible property (safe deposit box contents) or intangible property (securities-related property and general ledger property). Property becomes unclaimed and is therefore subject to the unclaimed property laws when is due and owing to a third party (the owner) after a specific period of time (the dormancy period) where there has been no contact with the owner. Shareholder accounts/securities are presumed abandoned upon on several factors, also known as dormancy triggers. Dormancy periods and trigger rules vary from state to state.

BLOCKCHAIN AND TRUST

Blockchain and Trust: An Inescapable Truth

The elusive creator of blockchain technology, Satoshi Nakamoto, opens his landmark whitepaper about Bitcoin with these words:

Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust-based model.” (Nakamoto 2008)

The impetus of his revolutionary new technology was his fundamental distrust in the “system.” He finds fault with the prevailing model, desiring to free man from the risks inherent to trust by replacing the “trust-based” system with a new, trustless, one. The whitepaper concludes with the ambitious claim that he has achieved his objective…

But is it really possible to eradicate trust from the system?

THIS IS US

From Dunder Mifflin to Confucius to ClearTrust

…our own Mission, Vision and Values has had a tall order to fill. They must be true to us, endure the seasons, and set the direction of our work. They must be custom-fit to us, such that they cannot be collectively worn by another company but can only be worn by us. And they must be brief, cutting straight to the point with no extra weight or empty words.

Then one day it nonchalantly came into focus, appearing in my mind as something that had been there all along but never given sufficient attention…

CAPITALISM UNDERGROUND IN CUBA

ClearTrust Founder Kara reflects on glimpses of capitalism caught during a recent trip to communist Cuba

Forty-five short minutes and our plane touches down in a world ostensibly trapped in time: La Havana. But this isn't the final destination for the team I am leading on a humanitarian trip. A six-hour layover stretches before us as we wait for our next flight. The airport of this nation's capital has a humble café serving beverages in a hot, humid waiting room…

These black market enterprises are everywhere, hidden in plain sight and just beyond the detection of the informants stationed on every block of every town by the Department of the Defense of the Revolution. For the consumers, these small entrepreneurial ventures keep families fed when shelves are empty and children clothed when prices are too high, offering an affordable alternative to state-run stores. For the merchant, these ventures offer a lifeline of hope that one day enough money can be saved to afford better nutrition, a car or even a home.

IRREVOCABLE TRANSFER AGENT INSTRUCTION LETTERS: CRITICAL QUESTIONS

Critical questions issuers should ask before agreeing to a convertible promissory note and irrevocable transfer agent letter.

Short on funding options from more traditional sources, many microcaps resort to convertible notes. In such transactions, the noteholder offers desperately needed capital in exchange for a Convertible Promissory Note. Accepting the funds, the issuer satisfies its immediate cash flow demands and survives to fight another day. But then it comes time to pay the piper.

Typically, once the note has “aged” in accordance with Rule 144, the debt can be converted into common stock at a steep discount and immediately sold in the marketplace (assuming all requirements of a Rule 144 resale has been met). The aggressive sale generally causes the stock price of the thinly traded microcap to drop, and each subsequent conversion request is computed at a lower stock price resulting in the issuance of more and more shares.

The stock price plummets, the float explodes, and the debt becomes harder and harder to pay off. It is the ultimate Death Spiral. It harms real investors. And yet, it is the only way some microcaps can obtain critical funding.

Some noteholders take advantage of a struggling issuer’s need for immediate funding….

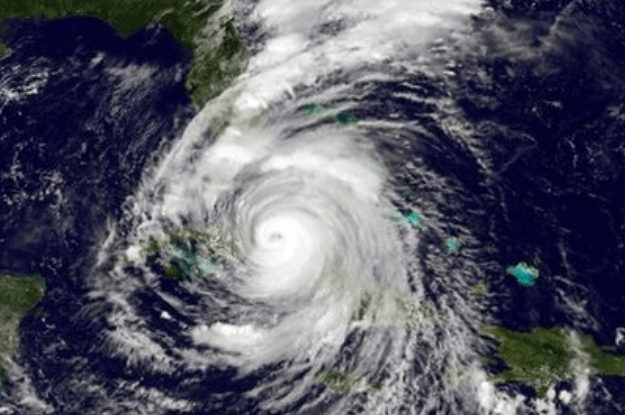

PEACE IN THE STORM: REFLECTIONS ON DISASTER RECOVERY

Reflections on Disaster Recovery and Hurricane Irma written in September 2017.

Watching Hurricane Irma barrel towards Florida gave me plenty of cause for worry. I worried about the safety of my family, my friends, my artwork, my fig tree. I worried about why on earth I was worrying about my artwork and my fig tree. But when it came time to worry about ClearTrust, I didn’t. To the best of our ability, we were ready.

As I write this, businesses are still boarded up, grocery store shelves are still empty, trees are down all around me and roads are flooded. Sitting in the thick of hurricane aftermath, disaster recovery seems an apt topic to write about. But a quick web search will prove the public domain is replete with credible advice for how to gauge risks, write a plan and implement it, so I will not venture to duplicate those efforts here.

I will, however, offer some reflection from my office in hurricane-prone Florida…

LEVERAGING LEGENDS TO ENFORCE INVESTOR LOCKUPS

How one simple step can protect your stock and save you thousands in legal fees.

Issuers of securities will sometimes require an investor to agree to a “lock up” or “leak out” provision that restricts or limits the public resale of shares for a certain period of time. This is very common among insiders and control persons, but can also be required of a non-affiliate investor. These special restrictions serve many functions, chief among which is to prevent downward pressure on the stock caused by large shareholders attempting to sell their holdings at once, or to stabilize the stock price after an IPO or large liquidation event.

However, a signed lock-up agreement might not be enough. If the legend is not clearly printed on the share certificate or share statement, it might not be enforceable.

While issuers have long assumed that a signed lock-up agreement is sufficient to prove the current investor has actual knowledge of a restriction, this is still not enough to ensure a lock-up will be enforced. A key reason is that brokers and clearing firms will ultimately….

A SPACE THAT SPEAKS

A good friend of mine is a corporate attorney in pristine, photo-ready, no-gum-on-the-sidewalks Singapore. The country sometimes feels more like a picturesque Orlando theme park than it does an Asian nation. It is unthinkable that a candy wrapper might fall to the street, and one can hardly find a flower drooping in a public park. It’s the only place I’ve ever been where it’s probably safe to eat off the ground. Singapore’s high-strung adherence to beauty and civil order is matched only by its stringent emphasis on work.

The importance and prominence of a disciplined work ethic is so deeply ingrained in this culture that it is expected families will employ at least one helper to care for family and home while both parents work full time jobs. A strong work force is critical to sustain this small-but-mighty country’s economy, and every worker matters. The life of a Singaporean is to be educated well, and then to work.

My Singaporean friend recently lamented to me, “I honestly don’t think work can be fulfilling.”

Bearing in mind that we both have relatively uninspiring jobs (let’s be honest that corporate legal work is about as thrilling as stock transfer work), it struck me how very different my outlook on work is...

ABOUT THE AUTHOR

Kara Kennedy, executive director and founder of ClearTrust, specializes in creating compliance solutions for growing companies, and helping business leaders and their shareholders navigate the increasingly complex regulatory environment. She applies over 15 years of experience in the financial markets to serve companies, and also consults for transfer agents in matters related to industry best practices, development of policies and procedures, and employee training. She serves on the Board of Directors of the Securities Transfer Association and is an active member of the Florida Bankers Association. She is a published author, with her first book now available globally - Supper: Reflections from our Table.

Kara graduated Summa Cum Laude from the University of South Florida with a Bachelor of Arts degree in Finance and International Business and is a member of business honor society Beta Gamma Sigma. She received her Master of Liberal Arts degree from Harvard University.