demystifying shareholder communications:

nobo, obo, and the street investor voting process

In the world of corporate governance and shareholder communications, terms like "NOBO" and "OBO" often cause confusion. Understanding these concepts and the process of distributing meeting materials and collecting votes from street investors is crucial for effective shareholder engagement. Let's break it down.

What are NOBO and OBO?

NOBO stands for Non-Objecting Beneficial Owner, while OBO stands for Objecting Beneficial Owner. These terms refer to shareholders who hold their shares through a broker or bank (also known as "street name" or "beneficial" holders).

- NOBO (Non-Objecting Beneficial Owner): These are shareholders who don't object to the company knowing their identity and contact information. Companies can obtain NOBO lists and communicate with these shareholders directly.

- OBO (Objecting Beneficial Owner): These shareholders prefer to remain anonymous to the company. Their identity is known only to their broker or bank.

The Process of Distributing Meeting Materials

When it comes to annual meetings and other shareholder communications, the distribution process differs for registered shareholders (those listed directly on the company's books) and beneficial owners (NOBOs and OBOs). Here's how it works for beneficial owners:

- Determining Beneficial Owners: ClearTrust performs a "broker search" to identify how many beneficial owners hold shares through each broker or bank.

- Material Preparation: The company and ClearTrust work together to prepare the proxy materials, including the proxy statement, annual report, and proxy card.

- Distribution to Intermediaries: ClearTrust sends these materials in bulk to Broadridge (the primary intermediary for most brokers) and the other broker intermediaries as needed.

- Final Distribution to Shareholders: ClearTrust sends meeting materials directly to registered shareholders, while Broadridge or the relevant intermediary distribute the materials to the beneficial owners.

BROKER SEARCH

DISTRIBUTE

The Voting Process for Street Investors

Collecting and tabulating votes from street investors involves several steps:

- Voting Instruction Forms: Beneficial owners receive a Voting Instruction Form (VIF) instead of a proxy card. They use this to instruct their broker how to vote.

- Multiple Voting Methods: Shareholders can typically vote via mail, phone, or internet, as specified on their VIF.

- Vote Collection by Intermediaries: Broadridge or the relevant intermediary collects these voting instructions.

- Vote Tabulation: The intermediaries tabulate the votes for their clients.

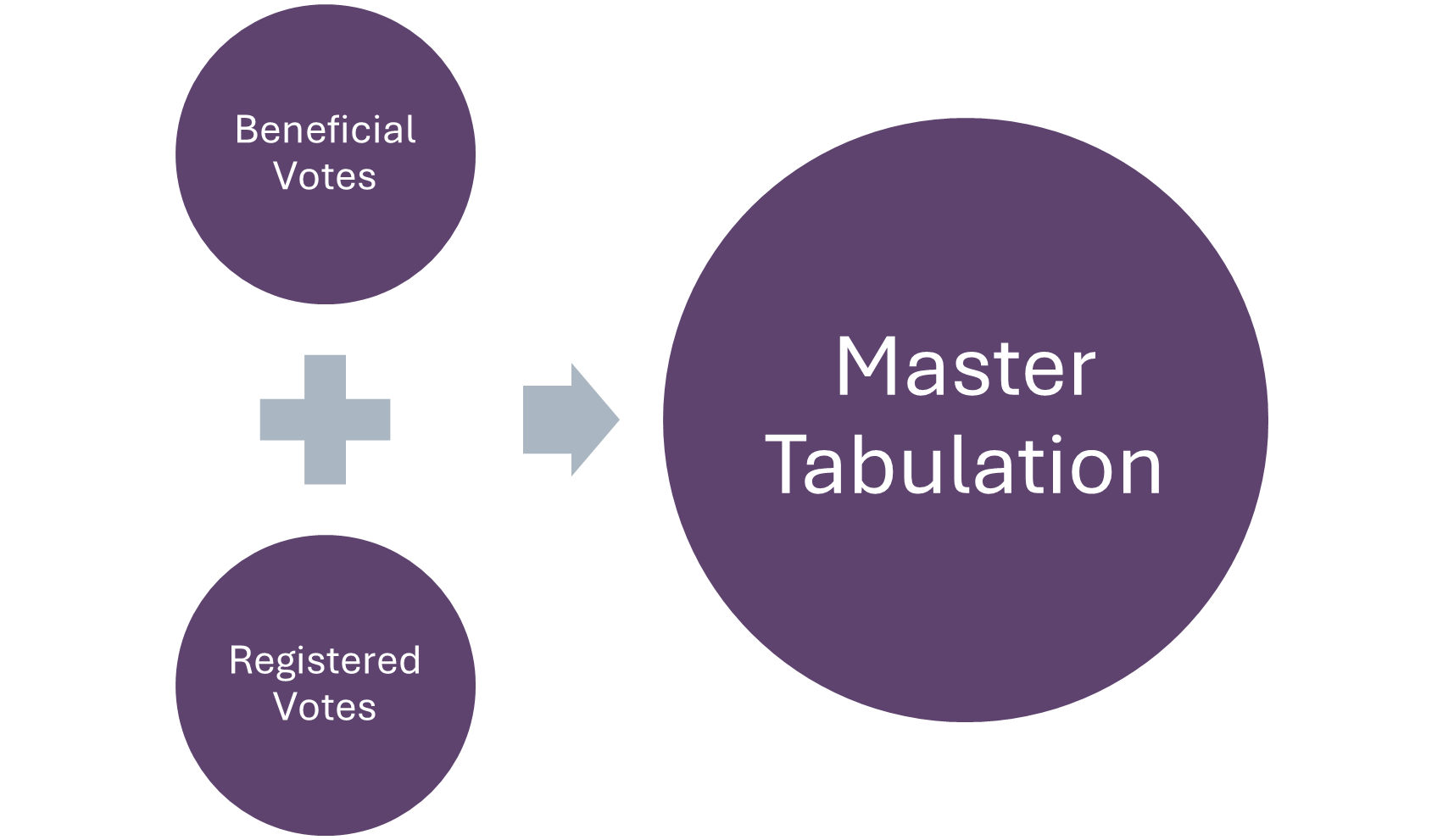

- Master Tabulator: The voting results are then forwarded to the company's master tabulator (ClearTrust). This is typically done through an omnibus proxy, which transfers the brokers' voting authority to the tabulator.

- Final Vote Tally: The master tabulator combines these street votes with the votes from registered shareholders to produce the final vote tally.

Why This Matters

Understanding the NOBO/OBO distinction and the street voting process is crucial for several reasons:

- Shareholder Communication: Companies can communicate directly with NOBOs but must rely on intermediaries to reach OBOs.

- Vote Solicitation: In close votes, understanding this process can help in developing effective vote solicitation strategies.

- Regulatory Compliance: Proper handling of NOBO/OBO distinctions is essential for compliance with SEC regulations.

- Accurate Vote Tabulation: Understanding how votes flow from beneficial owners to the master tabulator helps ensure accuracy and can be crucial in contested situations.

By grasping these concepts, companies can better navigate the complexities of shareholder communications and voting processes, leading to more effective engagement and smoother annual meetings. ClearTrust is poised to assist you every step of the way.